Alpha JWC Ventures: Powering the Next Generation of Southeast Asian Startups

Alpha JWC VC SEA 6 minutes

Alpha JWC isn’t just about writing checks—it’s about long-term, hands-on partnerships that propel companies toward sustainable growth. The firm invests between $100,000 to $20 million, primarily focusing on Seed to Series A startups, while also providing follow-on funding for Series B and beyond.

While sector-agnostic, it has demonstrated a strong interest in:

- Consumer

- B2B

- Retail

- Fintech

- Agritech

With a deep-rooted presence in Indonesia, Alpha JWC dedicates 80% of its investments to its home market while actively deploying capital in the Philippines, Vietnam, Singapore, and Malaysia.

Notable Investments & Portfolio Companies

Alpha JWC’s portfolio is a testament to its keen eye for scalable businesses that redefine industries. Some of its standout investments include:

- Ajaib – Indonesia’s first digital stock brokerage platform for retail investors

- Kredivo – A leading digital consumer credit platform

- Kopi Kenangan – The fastest-growing grab-and-go coffee chain in Southeast Asia

- Carro – A major player in Southeast Asia’s automotive marketplace

- Bobobox – Tech-enabled capsule hotels transforming budget travel

- Beleaf – An agritech innovator helping Indonesian farmers increase productivity

Bridging Founders with Investors

For ambitious founders looking to break into Southeast Asia or scale within it, finding the right investor is just as crucial as securing funding.

If you're building the next big thing and want to connect with Alpha JWC Ventures or similar top-tier investors, let WOWS Global help you navigate the landscape.

Get in touch with us today to explore opportunities and open doors to game-changing partnerships.

Related Posts

-

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

Esports Gaming Emerging Markets VC India 4 Minutes

Rooter: India’s Homegrown Game Streaming Giant

Rooter is India’s top game streaming platform, serving a fast-growing base of 17M+ monthly active users with local-language esports content and a thriving creator ecosystem. Backed by top VCs like Lightbox and March Gaming, Rooter has built a sticky, mobile-first product that’s monetizing rapidly through branded ads and virtual gifting. With plans for global expansion and profitability on the horizon, Rooter is one of the most promising gaming startups emerging from Asia. -

Investment Trends SEA MENA AI 6 Minutes

May 2025 Investment Snapshot: Capital Wakes Up Hungry

After a quiet Q1, global capital came roaring back in May 2025. From fintech and batteries in Singapore to quantum software in Israel, this month marked a bold return to frontier investing. WOWS Global breaks down where the money is flowing and why. -

1982 Ventures Fintech SEA 6 Minutes

1982 Ventures: Catalyzing Fintech’s Next Generation in Southeast Asia

1982 Ventures is betting big on fintech in Southeast Asia — and winning. Learn how this VC firm is backing early-stage founders and how WOWS Global helps connect startups to the capital they need. -

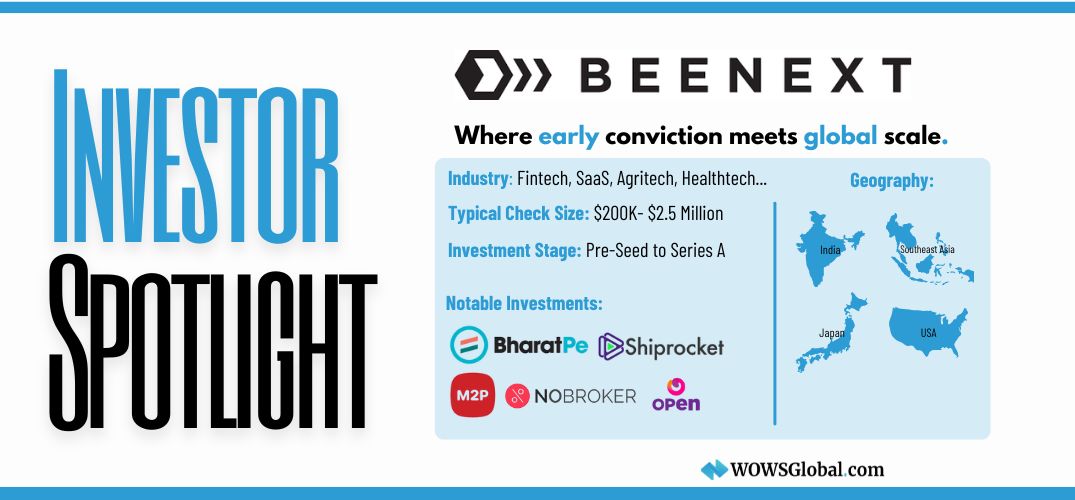

BEENEXT VC Early Stage 5 Minutes

VC Spotlight: BEENEXT – Backing Bold Founders from India to Southeast Asia

BEENEXT is a founder-first VC fund that has quietly become one of the most trusted early-stage backers across India and Southeast Asia. With over 300 investments and a long-term approach, the firm backs transformative companies in fintech, SaaS, logistics, and more. -

SEA 2025 startups 6 Minutes

Follow the Funding: What SEA’s 2025 Investment Landscape Reveals

Southeast Asia’s startup funding in 2025 is seeing a dramatic sectoral shift: while total capital is down 87%, AI and SaaS startups are booming, and traditional sectors like logistics, foodtech, and health are freezing. Here's what founders and investors need to know.