Empowering Companies and Investors to Thrive

Unlock Exclusive Investment Opportunities with Southeast Asia's Premier Matchmaking Platform for Startups and Investors

-

Empower Your Vision, Secure Your Future Connect with Investors and Accelerate Your Growth

The WOWS Investment Portal connects you with a global network of investors who are looking to support innovative companies like yours.

-

Showcase Your Company

Provide detailed information about your company, including your mission, milestones, and financials. Highlight what makes your business unique and how you plan to scale.

-

Engage with Investors

Interact directly with potential investors through the WOWS Investment Portal. Share updates, respond to inquiries, and build relationships that can lead to successful funding rounds.

-

-

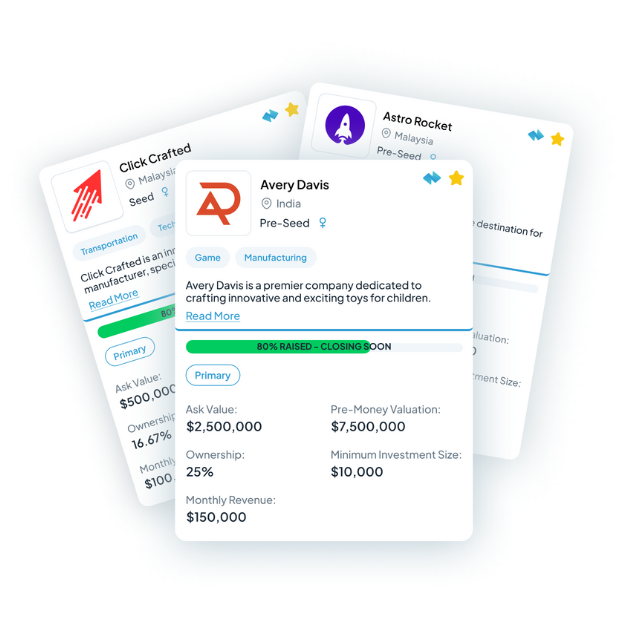

Discover Innovative Ventures, Invest in the Future Find the Next Big Thing in Tech and Innovation

Explore a curated selection of innovative companies seeking investment. Our platform provides detailed insights into each opportunity, helping you make informed decisions.

-

Curated Investment Opportunities

Gain access to a diverse range of startups and established businesses. Review detailed company profiles, financial data, and growth potential to identify the best investment opportunities.

-

Seamless Investment Process

Manage your investment process from start to finish with the WOWS Investment Portal. Communicate directly with founders, review updates, and track the progress of your investments with ease.

-

Proven Excellence in Service

-

Top-Rated on Capterra

Celebrated for outstanding service, our platform has earned a 5-star rating from satisfied users on Capterra.

-

Exceptional Support Recognized

Awarded for best-in-class support, we're proud to be acknowledged by Software Advice in 2023.

-

Best Value Distinction by Capterra

Honored with the Best Value award by Capterra, reflecting our commitment to deliver high-quality at great worth.

-

User-Approved on GetApp

User reviews on GetApp acclaim our solution's performance and user satisfaction.

Achievements by Numbers

Discover the power of connection on WOWS, where companies and investors connect and grow together.

-

Startups & SMEs

Growing daily with new innovators.

-

Investors

VCs, Angels, Family Offices & Private Equity

-

Million USD

In Equity reprepresented on the WOWS Investment Portal

Accelerating Success for Founders and Investors

At the crossroads of innovation and investment, our platform facilitates growth by connecting visionary founders with strategic investors. Navigate the future of fundraising and investment with customized solutions built for triumph in an ever-evolving market.

-

Expert Matchmaking

Discover your ideal startup or investor match with our intelligent pairing algorithm, designed to align interests and goals for long-term success.

-

Real-time Portfolio Tracking

Stay informed with live updates on your investments, empowering founders and investors with critical insights for strategic decision-making.

-

Seamless Fundraising

Navigate your funding journey with ease using our streamlined process that connects founders with top-tier investors.

-

Comprehensive Support

Benefit from our extensive resources and expert guidance to ensure a smooth fundraising experience and informed investment choices.

FAQs

Explore answers to your key questions on startup investment strategies, funding stages, and investor matchmaking on our comprehensive FAQ page

-

What is the WOWS Investment Portal?

The WOWS Investment Portal is an investment ecosystem designed to connect a diverse range of companies, including startups and SMEs, with potential investors to facilitate capital raises.

The platform offers various tiers of profile listings, each tailored to meet different needs and stages of company development. With services like the "Endorsed" and "Pitch Ready" plans, WOWS Global provides tools and resources that help companies enhance their appeal to investors and navigate the complexities of the investment process.

This includes features like WOWS-endorsed profiles on WOWS Deal Flow, dedicated investment managers, and comprehensive support for preparing investor meetings and negotiating term sheets. The platform ensures that investors have access to a curated pool of companies without any associated fees, streamlining the investment process and supporting dynamic growth within the business ecosystem.

-

Is there a specific sector or industry WOWS Global focuses on?

WOWS Global does not restrict its focus to specific sectors or industries. Instead, the organization is open to a wide range of companies across various fields. This inclusive approach allows WOWS Global to remain flexible and responsive to changing investment trends and investor interests.

-

What kind of investments can we expect through WOWS Global ?

Through WOWS Global, companies can expect a versatile range of investment types and sizes to accommodate various stages and needs of their business growth. This flexibility ensures that businesses across different sectors can find suitable funding options tailored to their specific requirements. Here’s a more detailed look at the kinds of investments available:

Primary Equity Raises: These are direct investments into the company for equity shares. Primary equity raises are fundamental for early-stage companies looking to build capital for expansion, product development, or market entry. This type of investment is typically utilized by startups and growth-stage companies aiming to scale their operations.Secondary Equity Raises: Unlike primary equity raises that fund company operations directly, secondary transactions involve the purchase of existing shares from other shareholders or founders. This can be beneficial for allowing early investors or founders to realize some gains from their investment or equity stakes without the company having to raise new capital.

SAFE Notes (Simple Agreement for Future Equity): SAFE notes are instruments that convert into equity at a later date, typically at the time of the next funding round. They are designed to simplify the early-stage investment process, providing startups with quick access to capital without immediately diluting ownership. SAFE notes are particularly popular among startups due to their simplicity and flexibility.

Venture Debt: This type of investment involves loans that are typically used by venture equity-backed companies to extend their runway and finance their operations without further diluting equity. Venture debt can be an attractive option for companies at various stages, providing them with the necessary capital to grow while potentially preserving shareholder value.

Investment Sizes: WOWS Global facilitates investments starting at smaller sums like $10,000, extending to larger, more substantial amounts. This range allows businesses of different sizes and at different stages—from seed to growth—to find appropriate funding. The wide range of investment sizes also attracts a diverse group of investors, from individuals looking for smaller equity positions to institutional investors interested in larger stakes.

By offering such a diverse array of investment types and sizes, WOWS Global ensures that businesses can access the capital they need in a form that best suits their current situation and future goals. This approach not only helps in fostering business growth but also in building robust, adaptable, and strategically financed companies.

-

What is the criteria to be listed for investments?

To be listed for investments on WOWS, companies must pass a basic audit for profile accuracy and completeness, with endorsed profiles undergoing a more detailed vetting process. Criteria include business viability, market potential, team quality, and alignment with investor interest.

-

What kind of investor network does WOWS Global provide access to?

WOWS Global provides your company with significant exposure within a robust network of venture capitalists, angel investors, family offices, financial institutions, and other investors. Through our platform, WOWS Deal Flow, we showcase your business to these potential investors. However, it's important to note that WOWS Global does not directly provide access to contact information or personal details of these investors.

The exposure on WOWS Deal Flow is structured so that investors can proactively reach out to your company if they find your business aligns with their investment criteria. This setup maintains investor privacy and allows them to initiate contact, ensuring that connections are made based on genuine interest and potential for successful partnerships. This method provides a respectful and efficient way for your business to be discovered and engaged by relevant investors from our extensive network.